Self-Employment Affidavit 2015-2025 free printable template

Show details

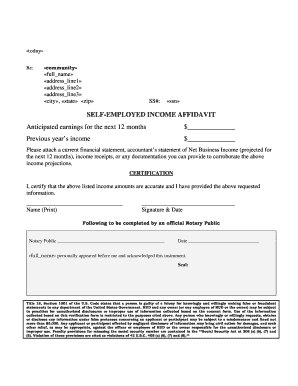

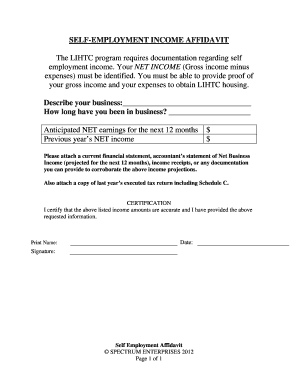

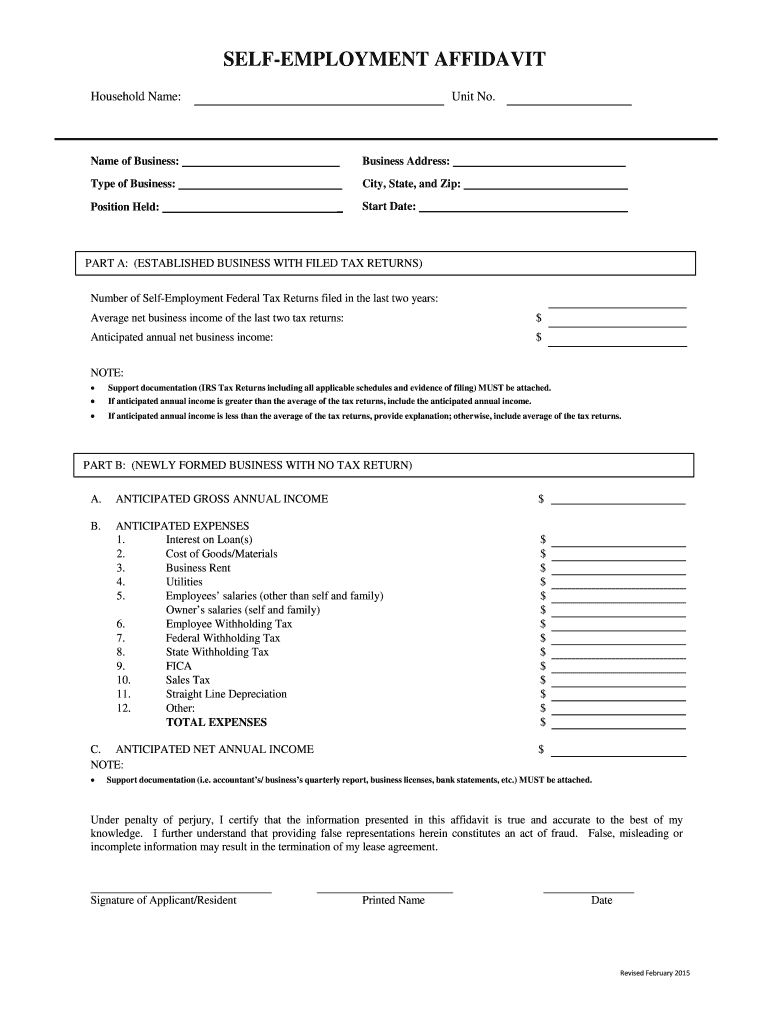

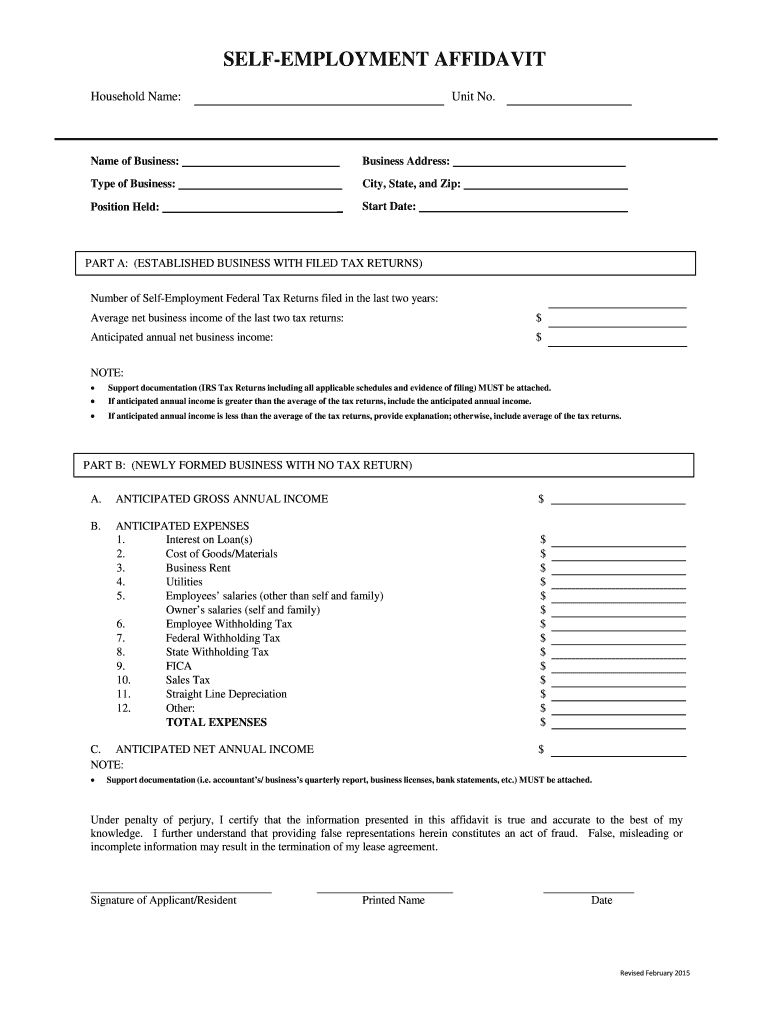

This document is used by self-employed individuals to provide information regarding their business and income for verification purposes, including tax returns and anticipated income and expenses.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign affidavit self employment pdf form

Edit your affidavit of self employment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self employment affidavit pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self affidavit format online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit self affidavit of income letter form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self affidavit form

How to fill out Self-Employment Affidavit

01

Start by downloading the Self-Employment Affidavit form from the official website or obtain it from the relevant authority.

02

Fill in your personal information, including your name, address, and contact details at the top of the form.

03

Provide details of your business, including its name, type, and address.

04

Indicate the nature of your self-employment and describe the services you offer or the goods you sell.

05

Include the date your self-employment began.

06

Attach any necessary supporting documentation, such as business licenses, tax identification number, or proof of income.

07

Review the completed form for accuracy and completeness.

08

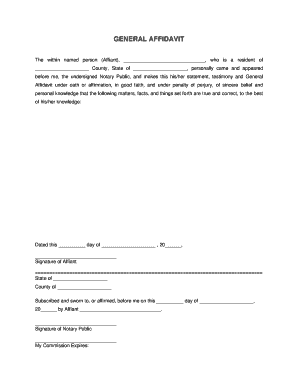

Sign and date the affidavit to verify that the information provided is truthful.

09

Submit the affidavit to the required agency or retain it for your records, depending on the purpose.

Who needs Self-Employment Affidavit?

01

Individuals who are self-employed and need to provide proof of income for loan applications, rental agreements, or government assistance programs.

02

Freelancers or independent contractors who need to establish their self-employment status.

03

Business owners applying for permits or licenses that require proof of self-employment.

Fill

self employment sworn statement

: Try Risk Free

People Also Ask about affidavit of employment

What is a self-employment statement?

A self-employment declaration letter is a document that discloses information about a person's work status as being self-employed. This letter can be used for various purposes such as obtaining a visa, child custody, applying for a job, applying for a loan, etc.

How can I prove my income without pay stubs?

You Could Show Your Tax Returns Turning in your tax returns is also a great way to prove your income when you do not have pay stubs. In fact, providing a copy of the last two years of tax returns will also show stability with your small business.

What are self-employment documents?

Any accurate, detailed record of your self-employment income and expenses. It can be a spreadsheet, a document from an accounting software program, a handwritten "ledger" book, or anything that records all self-employment income and expenses.

What is required to show my self-employed income?

There is no W-2 self-employed specific form that you can create. Instead, you must report your self-employment income on Schedule C (Form 1040) to report income or (loss) from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit.

Does a 1099 prove self-employment?

If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor.

Do I need receipts for self-employment?

Self-employment expenses For self-employed individuals, it is often helpful to save receipts from every purchase you make that is related to your business and to keep track of all of your utility bills, rent, and mortgage information for consideration at tax time.

What proof do I need for self-employment?

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete affidavit of self employment income online?

Filling out and eSigning how to write an affidavit for self employment is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the affidavit of self employment sample in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your self employment statement right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit affidavit for self employment on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute pre employment affidavit from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is Self-Employment Affidavit?

A Self-Employment Affidavit is a legal document that individuals use to declare their self-employment status, typically for purposes such as applying for loans, housing, or government assistance.

Who is required to file Self-Employment Affidavit?

Individuals who earn income through self-employment, freelancers, and independent contractors are typically required to file a Self-Employment Affidavit when requested by lenders, landlords, or governmental agencies.

How to fill out Self-Employment Affidavit?

To fill out a Self-Employment Affidavit, one should provide accurate details about their business, including the nature of services provided, income earned, and any relevant business identification numbers. The document often needs to be notarized.

What is the purpose of Self-Employment Affidavit?

The purpose of the Self-Employment Affidavit is to verify an individual's income source, which assists lenders, landlords, and agencies in making informed decisions regarding financial assessments or applications.

What information must be reported on Self-Employment Affidavit?

The Self-Employment Affidavit typically requires information such as the individual's name, address, business name, type of business, gross income, expenses, and the period for which the income is reported.

Fill out your Self-Employment Affidavit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Employment Declaration Letter is not the form you're looking for?Search for another form here.

Keywords relevant to self affidavit template

Related to printable self employment form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.